Gradement

Stock scores and factors to help with your DIY research

| About | Details |

|---|---|

| Name: | Gradement |

| Submited By: | Neal Jacobson |

| Release Date | 2 years ago |

| Website | Visit Website |

| Category | Investing |

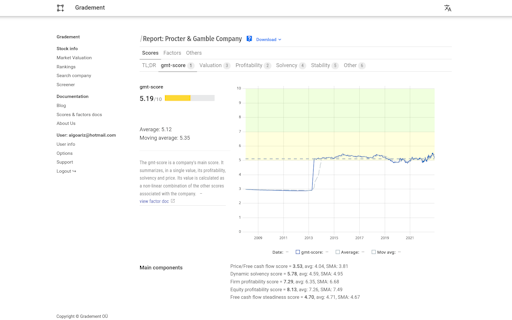

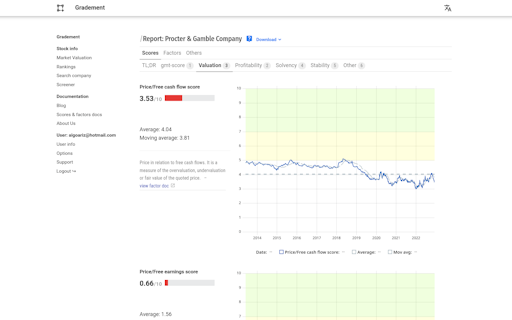

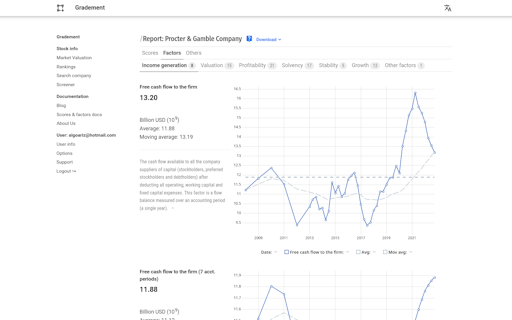

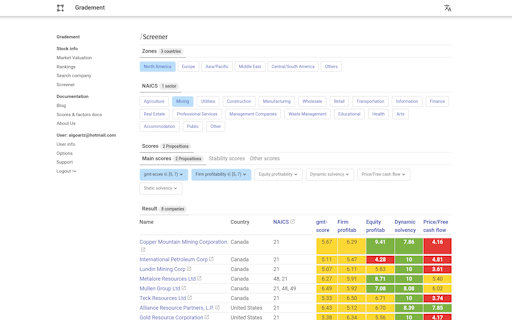

Easy-to-use scores and factors for investors, designed to consider as better those companies that are good (high profitability scores), that will not go out of business (high solvency scores), and quoted at fair price or better (high price/free cash flows).

Nice work @luis_fdez - looks like a very powerfuool tool. @will_geffen take a peek 👀

1 year ago

Hi you all, Product Hunt community, I'm the founder of Gradement OÜ: After years of crafting the factor scores and calculations to best summarize all the financial accounting information relevant to the company as an investment, and after designing the best possible UX to display them, the site has reached a state of development where I believe it is more than ready to present to the Product Hunt community. The scores and factors are designed for all levels of DIY investors in mind. You can either analyze an entire company simply by comparing a single score that summarizes, from 0 to 10, all the factors relevant to the investor (gmt-score), or analyze in more depth all aspects of the company through the remaining 20+ scores and 80+ factors relevant to the company. The underlying idea, based on Value-Investing and the Austrian School of economics as a theoretical frameworks, is to consider as better those companies that are good (high profitability score), that will not go out of business (high solvency score), and quoted at a more than fair price (high price/free cash flow score). For you to try it, you have full access for one week, together with a 25% permanent off promo code. All your suggestions and comments will be more than welcome! Happy research & investing, -- Gradement

2 years ago